The policies linked below are referenced in our Donor Advised Handbook and are here to support you in setting up a fund. Click on the links below to open a policy in a new tab on your browser. For any questions regarding these policies or for inquiries about Donor Advised Funds, please contact us at 805-543-2323 or email info@cfsloco.org.

Leaving Your Legacy with a Donor-Advised Fund

This content has been edited from its original version, which was created and published by National Philanthropic Trust. You can view the original article here.

Your estate plan is a powerful tool that can help you achieve many important goals. First and foremost, it allows you to provide for your loved ones when you’re no longer there. It can help you reduce probate fees, minimize your estate and inheritance taxes and plan how your affairs will be handled if you become incapacitated. It can also help you pass on something more: your values and beliefs.

For many people, this process—often called legacy planning—involves incorporating philanthropic goals into an estate plan. With a donor-advised fund (DAF), you have several ways of creating a lasting legacy. We will show you how a DAF can help ensure that your charitable work continues for future generations.

Planning a Charitable Legacy with a Donor-Advised Fund is part of CFSLOCO’s Philanthropic Services. Learn more at https://www.cfsloco.org/donors/

A simple solution for legacy planning: DAFs

A DAF is a charitable giving vehicle that is popular for its ease of use. To establish a DAF, you complete an application and make an irrevocable, tax-deductible contribution to fund the new account.

This typically involves naming your DAF—possibly using a family name like the Jones Giving Fund or the Jones Family Foundation—and, in most cases, appointing family members or others to serve with you as joint, secondary, or successor advisors. There are no start-up costs other than your initial contribution.

When you contribute to a DAF, you are making an irrevocable gift to charity, but you and any other individuals you appoint will retain advisory privileges—which include the right to recommend investments within and charitable grants from the DAF. Contributions made during your lifetime, which may include cash, appreciated stock, real estate, or other complex assets, generally receive an immediate income tax deduction for up to the full fair market value of the gift.

Bequests to a DAF are eligible for an estate tax charitable deduction and may also reduce applicable state inheritance and estate taxes, which together could result in significant tax savings. You may also make your DAF the beneficiary of a life insurance policy, retirement plan or charitable remainder or lead trust.

For instance, if your DAF is the beneficiary of a charitable remainder trust, you will not be constrained by a limited number of charities identified in the trust document. Instead, the trust’s assets can ultimately go to any charity the advisors of the DAF recommend. This gives you and your heirs the flexibility to meet the world’s changing needs.

Multiple ways to build a charitable legacy

While your DAF can be funded after your lifetime, one benefit of a DAF is the ability to involve your loved ones in giving during your lifetime. You can appoint a spouse or partner as a joint advisor, and name your children as secondary advisors, so that you can make charitable decisions together as a family.

You can also ensure that future generations can continue a legacy of giving by appointing individual successors to the DAF. Some legacy options include (but are not limited to):

- Naming a joint advisor to recommend investments and grants now and to assume responsibility of the DAF after your death

- Naming one or more individual successors to manage their own DAF account funded with your DAF assets

- Naming one or more charitable beneficiaries to receive all remaining DAF assets Establishing an endowment and recommending that assets be distributed over time in annual, recurring gifts to one or more charities

- Creating a Legacy Plan involving any combination of the options described above

You can choose the plan that’s right for you now, with the option to change it later.

A DAF in action: The Hernandez Family Giving Fund

Rose and Frank Hernandez were both in their late 50s and in their peak earning years when they began to think deeply about their charitable legacy. They wanted to find a way to provide lasting support for several small organizations, including one that had helped Frank’s parents when they first immigrated to the U.S. These small organizations were only equipped to receive gifts of cash, which meant that Rose and Frank often sold securities, paid the income taxes on the gains and then made the gift using the cash proceeds. The couple also wanted to involve their daughters, who lived in different cities, in giving.

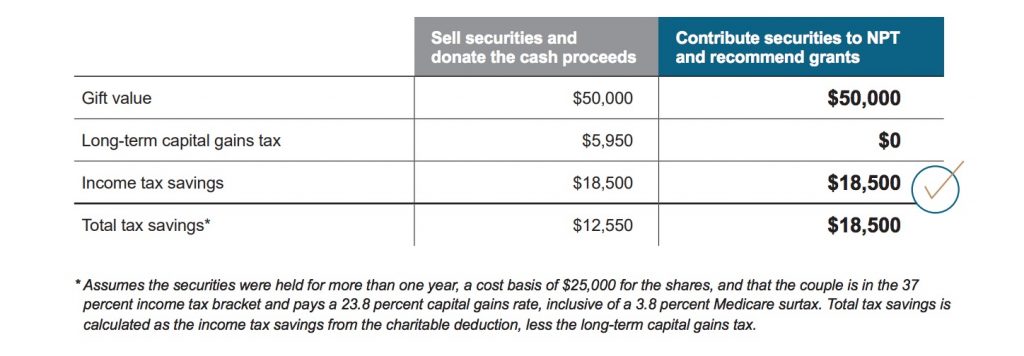

Rose and Frank decided to commit $50,000 to charitable giving in the current year, with an eye toward giving more in the future. Their advisor helped them consider two different strategies to achieve the goal:

GIVING TODAY: By setting up a DAF, Rose and Frank could serve as primary and joint advisors, and their daughters could work alongside them as secondary advisors and eventually as individual successors on the account. Rose and Frank also found that they could give more with a DAF, because it allowed them to give appreciated stock and save substantially on taxes. Their DAF offered Rose and Frank a seamless, tax-efficient way to donate stock which could then be liquidated for charitable grantmaking.

GIVING IN THEIR ESTATE: Although Rose and Frank’s net worth did not exceed the estate tax exemption amount, they had significant assets in traditional retirement accounts. These assets would be subject to income taxes if their daughters inherited them. Retirement assets left to charity, however, avoid estate and income taxation. This prompted Rose and Frank to make their DAF one of the beneficiaries of their retirement plan. Upon their death, the DAF would receive $150,000 of Individual Retirement Account assets, allowing the family to create a $100,000 endowed account to continue grantmaking to Rose and Frank’s favorite causes. At the same time, they could leave each daughter her own $25,000 DAF to continue supporting local organizations.

Advantages of starting your legacy today

Just as Rose and Frank did with their daughters in the example above, many families want to engage the next generation in their giving practice. A DAF can support your efforts to plan for your family’s future of giving, while allowing you to have a charitable impact today.

By establishing a DAF during your lifetime, you can:

- Involve family members in managing the DAF alongside you as joint or secondary advisors, so that you can give together to the causes that are important to you as a family.

- Appoint loved ones as individual successors and leave them a giving tool that requires no administrative work—the DAF sponsor oversees compliance, accounting, tax filing and other duties that the staff of a private foundation would otherwise have to do themselves.

- Contribute appreciated assets to receive a deduction for the full fair-market value of the gift and avoid paying capital gains taxes on the asset’s built-in gains.

- Save on income taxes. With the 2020 estate tax exemption at $11.58 million for individuals and $23.26 million for couples, fewer estates are subject to taxes than in the past. Opening a DAF now allows you to enjoy the benefits of a charitable income tax deduction, and ultimately to have more to give to your favorite causes.

- Support your favorite causes now and beyond your lifetime. You can use a DAF to make present-day giving easy, with options for recurring grants and specialized grant agreements. By establishing a Legacy Plan for the DAF, you may also ensure that your favorite nonprofits will be supported even after your death as beneficiaries, either with a lump-sum gift or via annual grants until your DAF assets are depleted.

If you would like to discuss these or other options, please email our team at info@cfsloco.org or (805) 543-2323. CFSLOCO does not provide legal or tax advice. This brochure is for informational purposes only and is not intended to be, and shall not be relied upon as, legal or tax advice. The applicability of information contained herein may vary depending on individual circumstances.